22 Четверг 2018

The Real Estate and Construction sector, constitutes one of the main pillars of the Cypriot economy, accounting for 14,1% of the country’s GVA in 2016. Following a period of severe market contractions, the number of real estate sale contracts dropped by 56% during the period 2010 – 2013. Throughout 2014 and 2015, there were signs of improved transaction activity and as a result of improved confidence in the Cyprus economy and the real estate market, a further significant increase was recorded in 2016 with total sales reaching a six-year high (YoY increase of 43%).

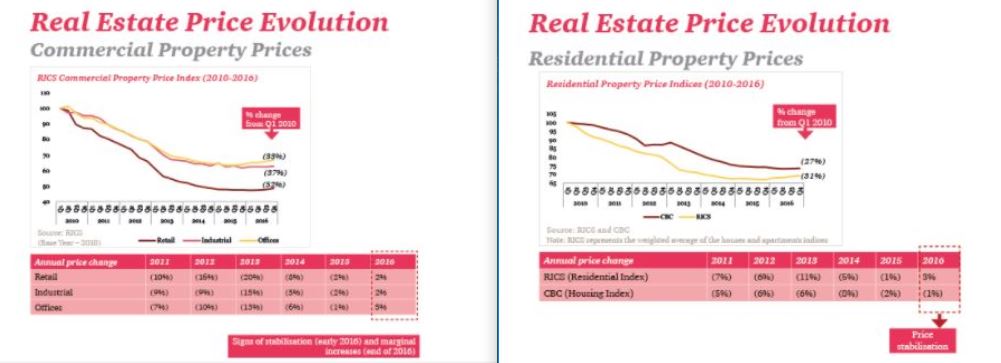

Real Estate Price Evolution

Prices for both residential and commercial properties exhibited a negative trajectory since 2010, reflecting the declining trend in domestic as well as foreign demand. This negative trajectory continued until 2015. By 2016, price index movements demonstrated signs of stabilisation and marginal improvement.

Foreign Transaction Activity

Throughout 2014 and 2015, demand from foreign buyers increased, demonstrating a Compound Annual Growth Rate (CAGR) of 15%. In 2016, a further significant increase was recorded with total properties reaching a six-year high (YoY increase of 34%). During 2016, the highest volume of properties for which sale contracts were filed by foreign buyers, was recorded in Paphos (35%), followed by Limassol (34%) and Larnaca (18%).

High- end residential property segment (> €1,5mln)

Demand for high-end residential properties (>€1,5mln) increased substantially from 2014 onwards. By 2016, the number of high-end residential transactions had almost quadrupled compared to 2013. The majority of transactions in the high-end residential segment across Cyprus is within the €2mln – €3mln band and Limassol has been the preferred location, comprising 63% of total transactions in 2016.

Construction Activity

In terms of the construction activity, in line with Cyprus’ economic recovery and given increased demand for properties, building permits have exhibited CAGR of 4,2% during the 2-year period to 2016.The majority of building permits, measured by licensed surface area (m2), relate to residential developments in Limassol (which makes up more than a third of licensed surface in 2016).